On becoming a member of our bank, you're not just a customer, you're an owner!

- Information on how to enter and the prize form part of these Terms and Conditions. Participation in this promotion is deemed acceptance of these Terms and Conditions.

- The Promoter is Australian Mutual Bank Ltd, ABN 93 087 650 726, Australian credit licence 236476, AFSL 236476, with registered office in 59 Buckingham Street, Surry Hills NSW 2010 (“Promoter”). The insurance policies forming part of this Promotion are issued by Insurance Australia Limited ABN 11 000 016 722 AFSL 227681 trading as CGU Insurance (CGU Insurance).

- Entry is only open to members of Australian Mutual Bank Ltd who are who are residents of any states and territories of Australia, aged 18 years or over. Employees (and their immediate families) of the Promoter and agencies associated with this promotion are ineligible to enter.

- Entries into the promotion open at 09:00am AEDT on 01/12/22 and close at 11:59pm AEST on 31/05/23 (“Promotional Period”), based on times applicable in NSW.

- To be eligible to receive one (1) automatic entry into the draw, entrants must:

a. During the Promotional Period, purchase a new Home Building, Contents, Building and Contents, Landlords or Comprehensive Car Insurance policy (“Eligible Policy”) through Australian Mutual Bank Ltd. Multiple entries are permitted. Each new policy is a separate entry.

b. Pay either in full or at least one instalment for the Eligible Policy through Australian Mutual Bank Ltd and provide Australian Mutual Bank Ltd a current email address; and

c. Not cancel the Eligible Policy for a period of at least 6 weeks following the date the relevant insurance cover takes effect (Six Week Period). - The Promoter reserves the right, at any time, to verify the validity of entries and entrants (including an entrant’s identity, age and place of residence) and reserves the right, in its sole discretion, to disqualify any individual who the Promoter has reason to believe has breached any of these Terms and Conditions, tampered with the entry process or engaged in any unlawful or other improper misconduct calculated to jeopardise fair and proper conduct of the promotion. Errors and omissions may be accepted at the Promoter's discretion. Failure by the Promoter to enforce any of its rights at any stage does not constitute a waiver of those rights. If there is a dispute as to the identity of an entrant, the Promoter reserves the right, in its sole discretion, to determine the identity of the entrant.

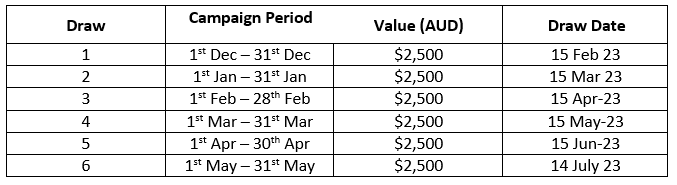

- Eligible participants will be entered in a monthly draw for the chance to win $2,500 (Cash Prize). The Promotion consists of six (6) separate draws. The draws will take place at Australian Mutual Bank office, 19 Second Ave, Blacktown, NSW 2148 on the days specified below at 10:00am, based on times applicable in NSW:

The Promoter may draw additional reserve entries and record them in order in case an invalid entry or ineligible entrant is drawn. The winner will be notified by Australian Mutual Bank Ltd. by email and telephone within three (3) business days of the draw. A redraw for any prize, if unclaimed, may take place on 28 July 2023 at the same time and place as the original draws, subject to any directions from a regulatory authority. The winner(s), if any, will be notified by telephone and email within three (3) business days of the draw. Each individual winner’s last name, first initial and postcode will be published on https://australianmutual.bank/campaigns/cgu-rain-hail-or-shine on 28 July 2023. - The total prize pool for the entire promotion is AUD $15,000.00.

- This Promotional offer cannot be used in conjunction with any other insurance offers available through Australian Mutual Bank Ltd. The Promoter collects personal information about entrants to enable them to participate in this Promotion in accordance with the privacy policy available at https://australianmutual.bank/about-us/privacy/ . It is a condition of the Promotion that this information is provided.

- Australian Mutual Bank Ltd acts under its own Australian Financial Services Licence and under an agreement with the insurer Insurance Australia Limited trading as CGU Insurance ABN 11 000 016 722, AFSL 227681. Any advice given is general only and does not take into account your personal objectives, financial situation or needs. Consider the relevant Product Disclosure Statement (PDS) and Target Market Determination (TMDs) available at www.australianmutual.bank to see if the product is right for you.

- If for any reason any aspect of this Promotion is not capable of running as planned, including by reason of computer virus, communications network failure, bugs, tampering, unauthorised intervention, fraud, technical failure or any cause beyond the control of the Promoter, the Promoter may in its sole discretion cancel, terminate, modify or suspend the Promotion and invalidate any affected entries, or suspend or modify a prize, subject to State or Territory regulation.

Authorised under: NSW Authority Number: TP/2291. SA Permit No. T22/1842. ACT Permit No. TP22/02230.1